Briefing on Tax Extended Deadlines and ECQ-related Donations

COVID-19 continues to be an economic disruptor affecting many businesses in our country and the economy as a whole. In response to this, the Philippine Government, through various regulatory agencies, made measures to cushion the economic impacts of COVID-19 to the business community. From a taxpayer's perspective, the extension of tax filing deadlines and deferral of tax payments are among the government measures which will ease cash flow pressures on businesses.

The DOF and BIR have also welcomed massive donations and relief operations from various sources in support of protecting the lives and livelihoods of Filipinos. Envisioned to encourage continued outpour of assistance to the community in true Bayanihan spirit, the BIR also granted tax relief on such donations to return the generous gestures of donors.

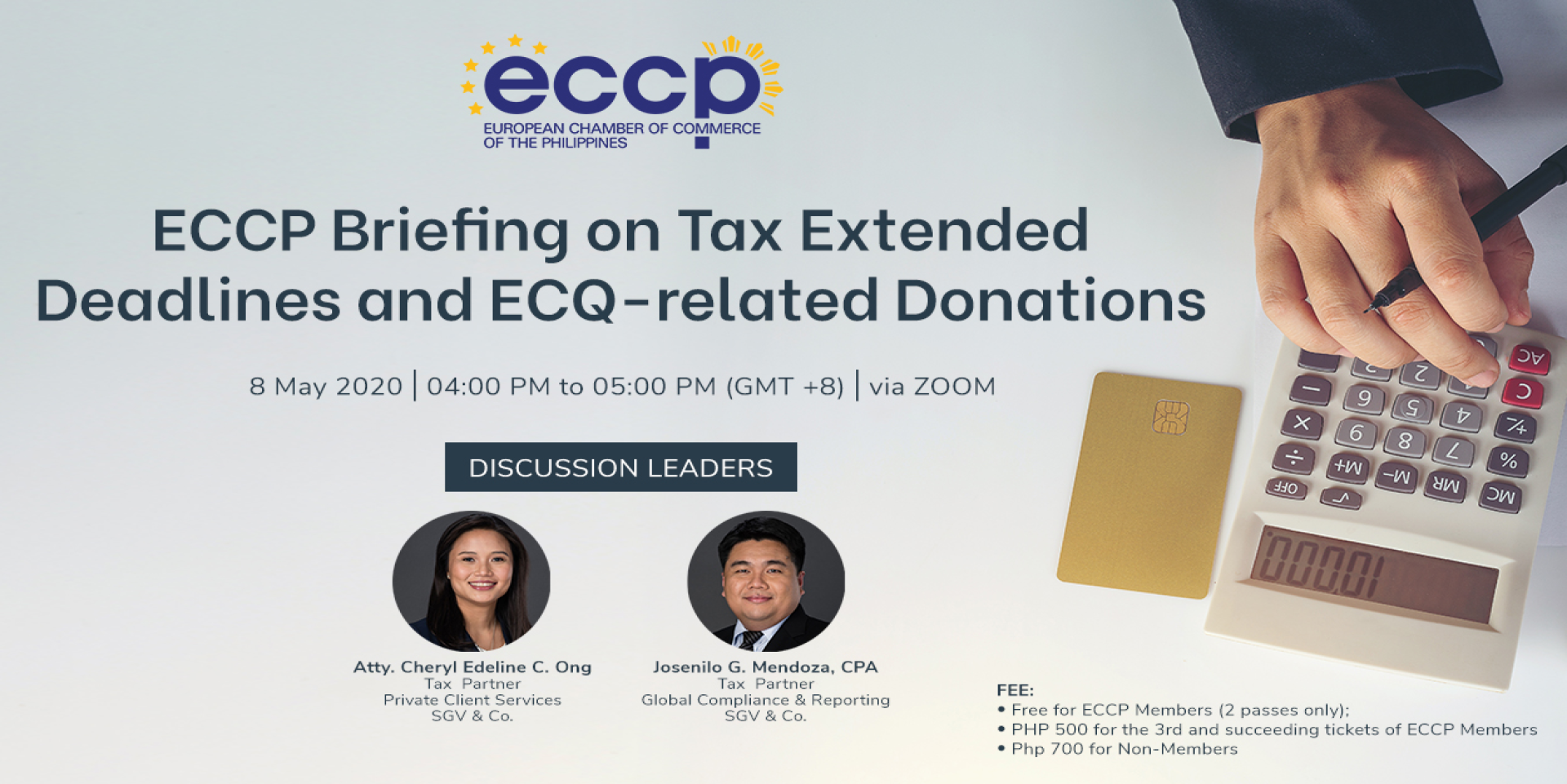

At the ECCP Briefing on Tax Extended Deadlines and ECQ-related Donations on 08 May, we will be joined by tax partners Josenilo G. Mendoza, CPA and Atty. Cheryl Edeline C. Ong to discuss the latest BIR issuances on the extension of statutory tax deadlines and tax relief on donations made during the state of national emergency.

| TIME | ACTIVITY |

|---|---|

| 3:00 pm - 4:00 pm

1 hour |

Registration |

| 4:00 pm - 4:05 pm

5 minutes |

Opening Remarks and Introduction of Speaker |

| 4:05 pm - 4:20 pm

15 minutes |

Josenilo G. Mendoza

Tax Partner Global Compliance & Reporting | SGV & Co. |

| 4:20 pm - 4:35 pm

15 minutes |

Atty. Cheryl Edeline C. Ong

Tax Partner Private Client Services | SGV & Co. |

| 4:35 pm - 4:55 pm

20 minutes |

Open Forum

Josenilo G. Mendoza Tax Partner Global Compliance & Reporting, SGV & Co. Atty. Cheryl Edeline C. Ong Tax Partner Private Client Services, SGV & Co. Moderator Atty. Anne Margaret E. Momongan Director, SGV & Co. |

| 4:55 pm - 5:00 pm

5 minutes |

Wrap-up and Closing |

Slots are limited and on a first come, first served basis.

Two complimentary passes;

Php 500 for additional attendee

ECCP Members

PHP 700

Non-Members

How to access the webinar: In a separate email, you will receive the link sent via ZOOM/ECCP.

For inquiries, kindly email jillian.sitchon@eccp.com.