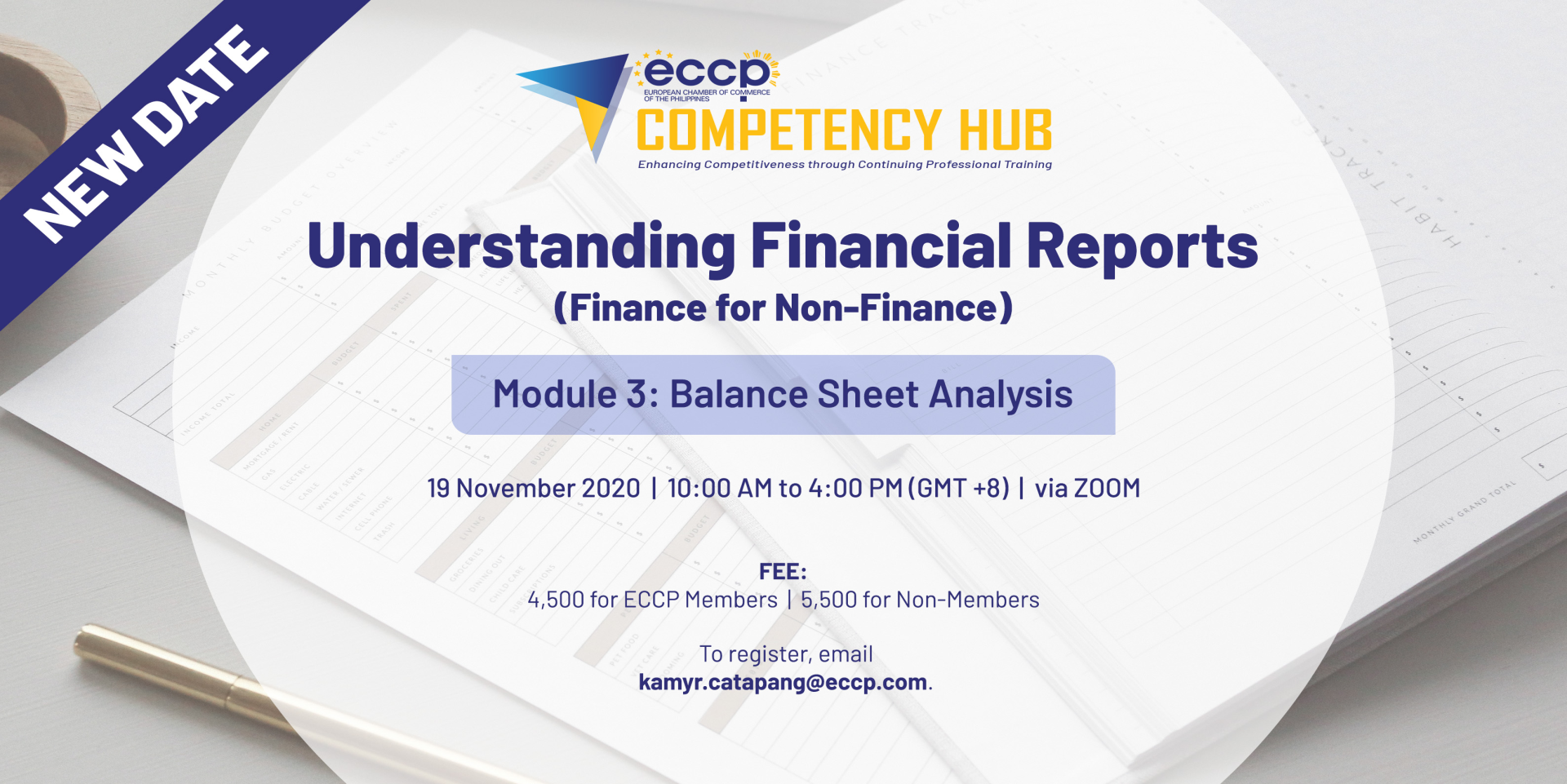

Understanding Financial Reports: Module 3 - Balance Sheet Analysis Module

"Financial Reports are as revealing of the HEALTH OF A BUSINESS as the pulse rate and blood pressure are indicators of the HEALTH OF A PERSON."

A fundamental financial objective of all organizations is to be healthy and stable. The financial reports are the means of the company to summarize and communicate financial performance.

If all the organs and parts of the body contribute to the well-being of the person, it also follows that the different sections/departments of the company contribute to its financial condition.

- Evaluate the asset mix and the capital structure of the company

- Assess the financial condition of the company by using Balance Sheet indicators

- Liquidity

- Cash Conversion Cycle

- Minimum Cash Requirement

- Leverage

- Coverage Measures

- Prepare a cash flow statement and interpret its information

Pre-session:

- Prerequisite: Attended Module 2 or have a solid background in the profitability analysis

- List of Ratios and Formulas

- Financial Analysis Process

Module 2 (AM session: 10:00 AM to 12:00 NN)

- Vertical Analysis of the Balance Sheet

- Asset Distribution

- Capital Structure - Leverage Discussion

- Analysis of the Cash Conversion Cycle

- Introduction to the Cash Flow Statement

Session Break (12:00 NN to 01:59PM)

Module 2 (PM session: 02:00 PM to 04:00 PM)

- Analysis of the Cash Flow Statement

- Discussion of Leverage & Coverage Measuresv

- Recap of Financial Ratios

- Summary of the Financial Analysis Process

Slots are limited and on a first come, first served basis.

Php 4,500

ECCP Members

PHP 5,500

Non-Members

How to access the webinar: In a separate email, you will receive the link sent via ZOOM/ECCP.

For inquiries, kindly email kamyr.catapang@eccp.com