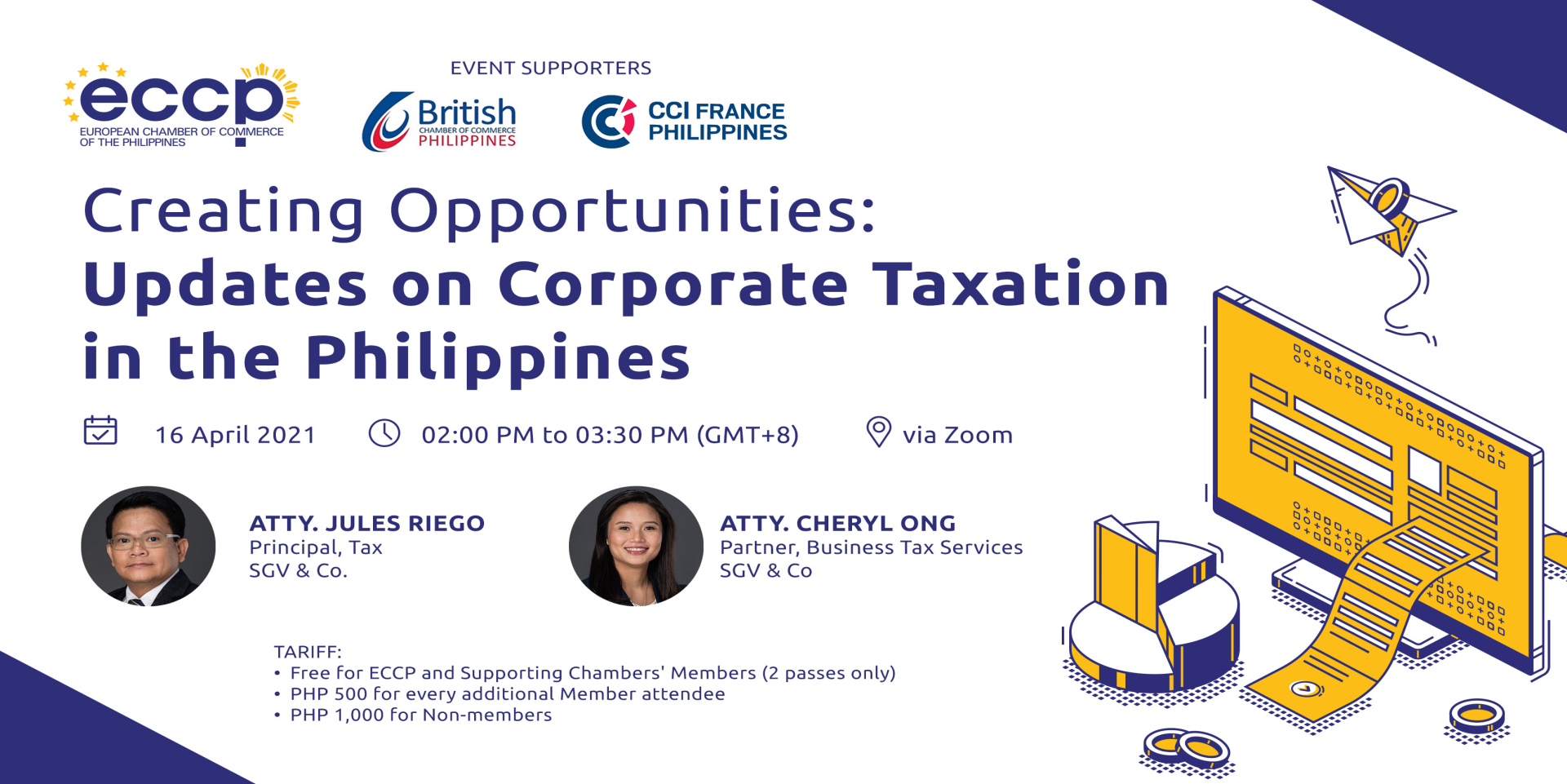

Creating Opportunities: Updates on Corporate Taxation in the Philippines

A strong and competitive fiscal policy is a crucial factor in the Philippines' attractiveness to both local and foreign investors, and the overall economic development. It then goes without saying that this can also significantly support the country's recovery from the COVID-19 pandemic. Among these important fiscal measures is the CREATE or Corporate Recovery and Tax Incentives for Enterprises Act which seeks to reduce the Philippines' corporate income tax. The ECCP has advocated for this piece of legislation as it will help make the country more competitive among its ASEAN peers.

With the CREATE now signed into law as Republic Act No. 11534, the ECCP is organizing a virtual forum entitled "Creating Opportunities: Updates on Corporate Taxation in the Philippines" on 16 April. With experts from SGV & Co. Philippines, this event will walk companies through the salient points of this new piece of legislation, and bring to light how it will affect business operations.